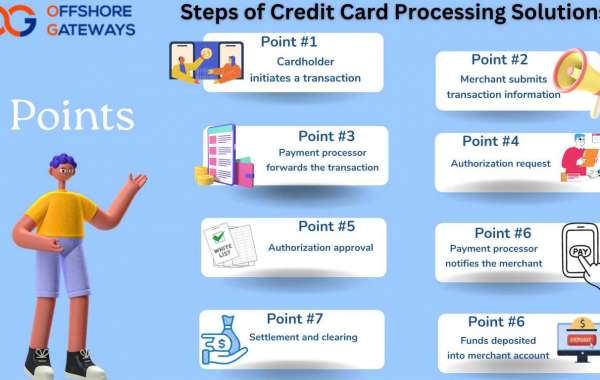

Here are the general steps involved in credit card processing solutions:

Cardholder initiates a transaction: The process begins when a customer uses their “credit card” to make a purchase at a merchant’s point of sale (POS) system, online store, or through other payment channels like mobile apps or over the phone.

Merchant submits transaction information: The merchant collects the necessary transaction details, including the credit card number, expiration date, CVV (Card Verification Value), and the transaction amount. This information is securely sent to “the payment processor”.

Payment processor forwards the transaction: The “payment processor acts” as an intermediary between the merchant and the card networks (Visa, Mastercard, etc.). It encrypts the transaction data and forwards it to the appropriate card network.

Authorization request: The card network receives the authorization request from the payment processor. It verifies the card details, checks for available credit or funds, and determines whether the transaction should be approved or declined.

Authorization approval: If the card details are valid, and there are sufficient funds or credit available, the card network sends an authorization approval back to “the payment processor”. This indicates that the transaction can proceed.

Payment processor notifies the merchant: Upon receiving the authorization approval, the “payment processor” notifies the merchant that the transaction is approved. The merchant can then proceed with providing the goods or services to the customer.

Settlement and clearing: After the transaction is completed, “the payment processor initiates the settlement process”. The clearing process reconciles and settles transactions between the banks and the card networks.

Funds deposited into merchant account: Once the settlement is complete, the funds from the transaction are deposited into the merchant’s bank account. The time it takes for funds to reach the merchant can vary depending on “the payment processor” and the merchant’s bank.

Customer statement: The cardholder will see the transaction reflected on “their credit card statement”, showing the amount spent and the merchant’s name.

Reconciliation and reporting: Both the merchant and the payment processor reconcile their records to ensure all transactions are accounted for accurately. Reporting tools may be used to provide detailed insights into sales, fees, chargebacks, and other transaction-related data.

These steps ensure that “credit card transactions are processed” securely, protecting both the cardholder’s sensitive information and the merchant’s financial interests.

#Paymentprocessor | #Offshoregateways | #Acceptingpaymentonline |

#Onlinepaymentprocessors | #Bestcreditcardprocessing |

#Merchantprocessing | #Creditcardprocessor | #Merchantaccountinuk |

#2dspaymentprocessingforcasino | #Offshorecreditcardprocessing |

#Adultpaymentprocessing | #Paymentprocessorvspaymentgateway |

https://www.offshoregateways.com/credit-card-payments/top-10-virtual-ibans |

https://www.offshoregateways.com/credit-card-payments/credit-card-processing-speed |

https://www.offshoregateways.com/credit-card-payments/payment-gateway-vs-payment-processor |

https://www.offshoregateways.com/credit-card-payments/payment-security-measures |

https://www.offshoregateways.com/credit-card-payments/tips-online-fraud-prevention-for-businesses |

https://www.offshoregateways.com/credit-card-payments/choose-best-credit-card-processing-company |